Countdown to COP26: Energy Transition

Predictions become easier with convergence to a grand theme

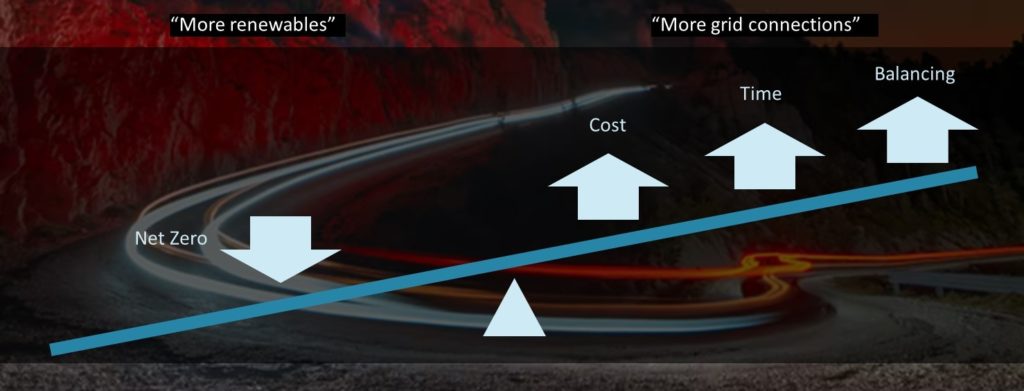

As we move deeper into decarbonisation and the trajectory towards net zero emissions globally, the roadmap going forwards becomes easier to read in some respects as convergence to net zero will have to result in certain behaviours within and between sectors along the way. This will be true of the quantum of investment needed, the number and type of investors, generation, demand, storage, balancing the power grid at large and how innovation solves some of the more difficult challenges. One such prediction, backed by what we are seeing, is that there is and continues to be a rise in competition for grid connections in a feedback loop resembling Figure 1:

In the past 6 months the UK development pipeline continues to grow; offshore wind (+36%), onshore wind (+13%), solar PV (+23%) and battery storage (+30%). Increasingly, grid reinforcements will be triggered as offshore wind seabed leasing rounds move into the execution phase driving more pivotal change in GB grid design and operation.

So, a question we ask is how can our clients accelerate value capture in an increasingly crowded marketplace whilst also moving towards net zero emissions?

The answer may be – partially – blowing in the wind

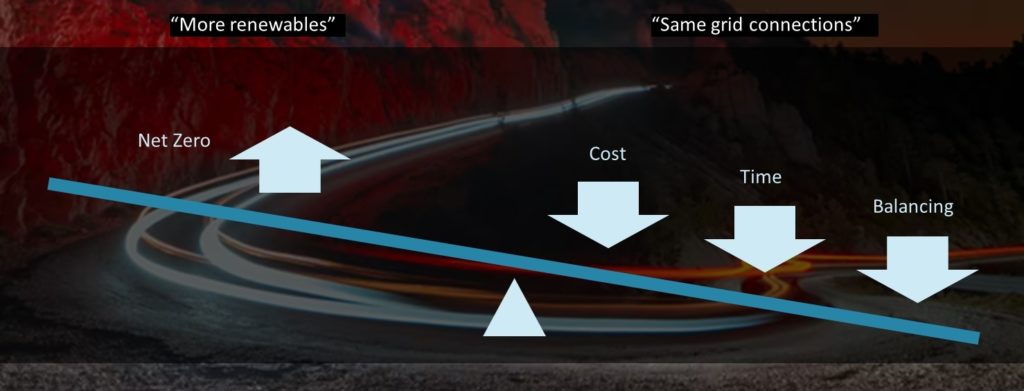

One near term strategy may favour investors with existing operational and/ or development pipelines of onshore wind. If solar PV can be added using the same grid connection in a hybrid renewables scheme, we may flip our grid scarcity model on its head to a grid optimisation model as shown illustratively as Figure 2:

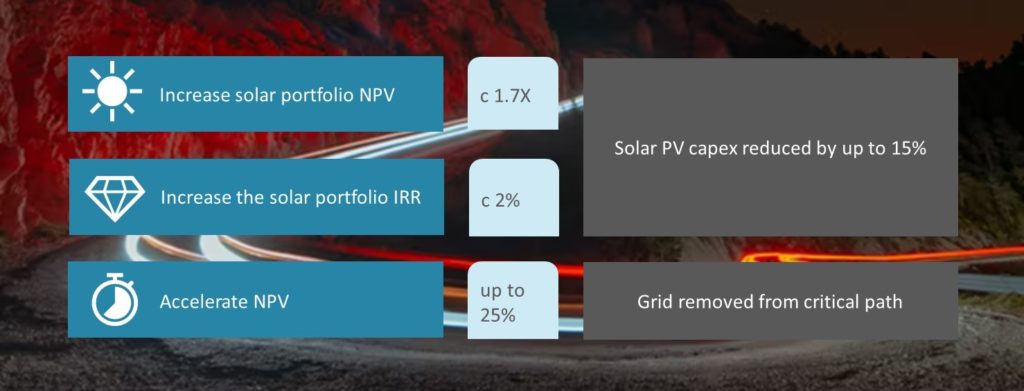

Moreover, as we start to model what this system looks like, we can ascribe certain illustrative KPIs and trends as shown in Figure 3:

The first two commercial benefits relate to reducing the total solar PV capex by up to 15% as the same grid connection is used and the way in which NPV and IRR formulae work. The third commercial benefit exists from the potential range of grid connection times that may add years onto a standalone solar PV project. Using the existing grid connection removes this from the project critical path in many cases.

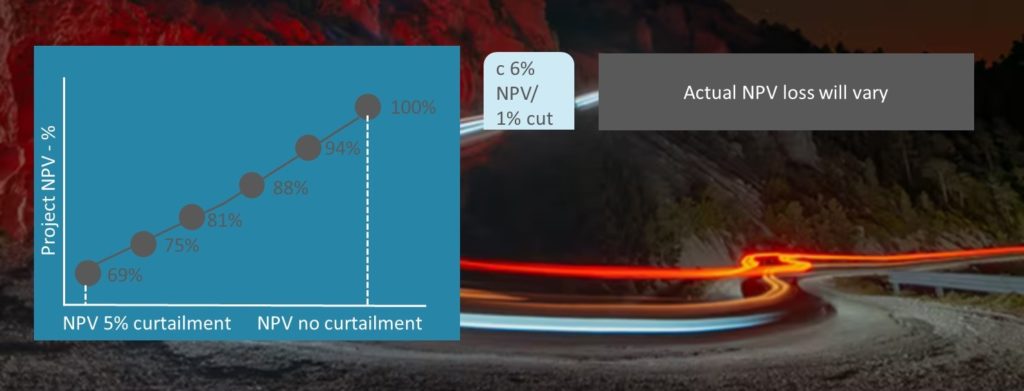

A diagram of project delay due to grid connection being a pacing item versus NPV today is an interesting insight. This is shown illustratively in Figure 4.

Finally, ESG benefits are enhanced by a hybrid renewables portfolio as renewable energy density increases, improving the carbon intensity of grid electricity. It is also likely that balancing requirements are reduced with the negative correlation of wind and solar. Execution risk also has the potential to lower given the established relationships with key project stakeholders from the wind development.

Offsetting curtailment risk

Curtailment may be a risk that can be calculated when optimising the size of the solar PV project to be added. It is possible to derive what the shape of this risk if the impact is born entirely by the solar PV project as Figure 5 below:

An insight ITPEnergised has identified is that this risk could be traded off with some of the NPV acceleration by superimposing the two trendlines of NPV acceleration and NPV loss due to curtailment and shifting these lines as appropriate to the case under consideration as Figure 6:

Sharing value

The foreseen benefits may also be shared with the wind portfolio “owners” as well as the added solar PV “owners” incentivising strategic action across the combined portfolio from TopCo. The NPV upside can also be used as a value shield or sacrificial NPV, to enable an investor to take some merchant risk in the battery storage and/ or green hydrogen markets for example, all without cutting off the nose to spite the face. In summary, net zero is accelerated and the GB grid utilisation factor is increased resulting in acceleration of cashflow, enhancing ESG benefits and reducing project execution risk.

Hybrid renewables have been written about in our thought leadership series here. ITPEnergised has recently developed a smart digital tool to systematically produce a prioritisation funnel for your wind portfolio, producing a range of technical, commercial and ESG KPIs, to help inform the hybrid renewables conversion investment decision.

For more information on this article, please contact Peter Lo, Head of Onshore Renewables & Storage at peter.lo@itpenergised.com.

* Please note figures are illustrative and vary from project to project and route to market