This ITPEnergised insights series examines the techno-economics of solar PV and battery storage colocation projects in the GB (Great Britain) market. The series is arranged with an introduction to battery storage first, then builds from this in the remainder of the series to discuss the key value drivers of additionally including solar PV with battery storage in colocation (figures are illustrative).

- Part 1 – Battery Storage and Energy Arbitrage

- Part 2 – Introducing the Techno-Economics of Solar PV and Battery Storage Colocation Projects

- Part 3 – Impact of Wholesale Price Volatility on Solar PV and Battery Colocation Techno-Economics

- Part 4 – Key Drivers of Solar PV and Battery Colocation Techno-Economics

Part 2 – Introducing the Techno-Economics of Solar PV and Battery Storage Colocation Projects

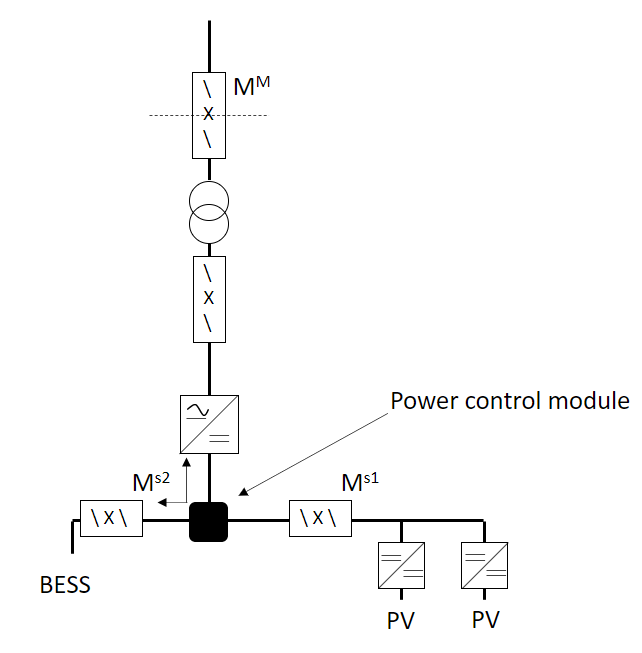

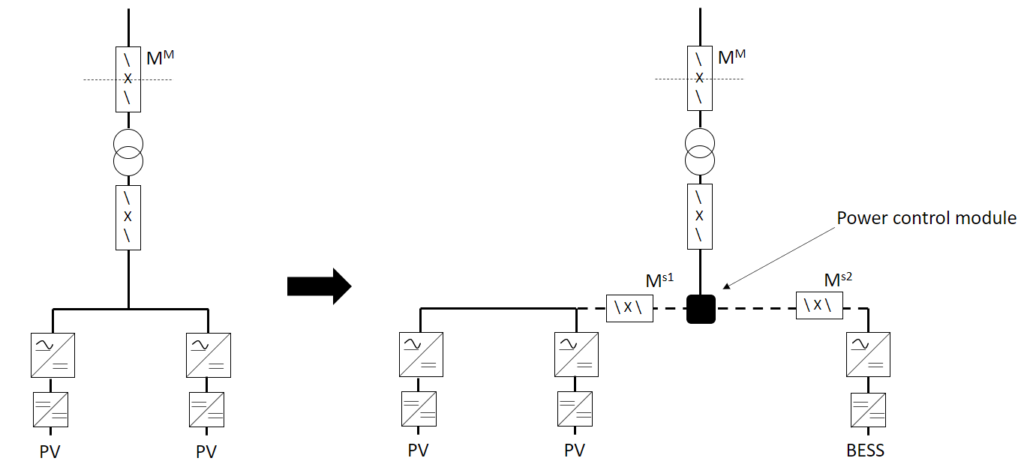

For colocation we use the definition for this insight series where a solar PV farm is connected to the same main grid connection as battery storage. Wind farms will be considered in a later insight series. A single line diagram is shown below for a greenfield solar PV and battery storage colocation project that is DC coupled and a retrofit project with battery being added to an existing solar PV project which is AC coupled. Both schemes are shown with separate import-export metering.

Key :

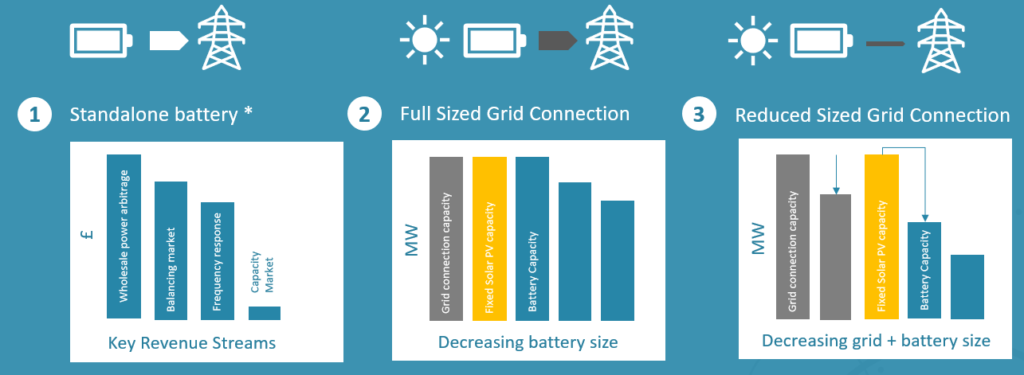

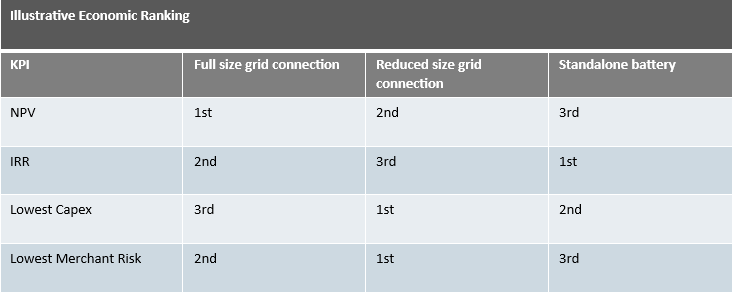

We then consider three cases of techno-economic study to drive a comparative analysis of NPV, IRR, investment capex and ratio of merchant to contracted revenues which is a proxy for risk appetite. The three optimisation frameworks are shown in the diagram below.

Case 1 concerns a standalone battery storage project and the associated revenue streams that can be back tested to the market.

Case 2 considers a full-sized grid connection adequate to export the full capacity of the solar PV farm with varying levels of battery capacity at a fixed duration to derive the optimum economics and compare the techno-economics of a standalone solar PV before to the colocated project after.

Case 3 is used to drive better techno-economic-capex-risk outcomes, where we over plant the solar PV farm and make it larger than the grid connection itself in capacity terms. This reduces grid connection capex whilst improving grid connection load factor with smaller grid connection schemes having the potential for more accelerated times to connect enabling faster positive cash flow for a project. Again, we compare the techno-economics of a standalone solar PV before to the colocated project after.

Our methodology is proprietary but as we discover more information through our due diligence or technical development process with our grid, renewable technical services, and environmental planning teams we continue to optimise the techno-economics. This then gets reflected into the technical design whilst still ensuring the configuration fits within the planning regime and grid connection parameters.

A summary of an illustrative case for the three techno-economic frameworks is shown in the table below, assuming the same solar PV capacity and that the solar PV and battery project use the same discount rate. Please note results can vary from project to project.

You can view and download a PDF of this article here.

In our remaining insight articles, we will examine some of the key drivers of colocation economics, including the impact of wholesale price volatility, location within GB and finally a summary of the key drivers of colocation project value. To find out how we can help you optimise the size your colocation project and to provide accompanying due diligence services please contact peter.lo@itpenergised.com.

© Copyright 2023 ITPEnergised. The concepts and information contained in this document are the property of Energised Environments Limited, ITPE Ltd and Xero Energy Limited, trading as ITPEnergised. Use or copying of this document in whole or in part without the written permission of ITPEnergised companies constitutes an infringement of copyright unless otherwise expressly agreed by contract.

These materials are not intended to be and do not constitute a recommendation to any person or entity as to whether to acquire or dispose of or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient relying on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipient’s own professional advisors and such other experts as it deems relevant.

In preparing this document, ITPEnergised has relied on publicly available information and has assumed, without independent verification, the accuracy and completeness of all such information. To the extent permitted by law, ITPEnergised does not accept any liability whatsoever for any loss howsoever arising, directly or indirectly, from use of or reliance on, this document or any other written or oral communications with or information provided to the recipient in connection with its subject matter. ITPEnergised has not conducted any evaluation or appraisal of any assets or liabilities of the company or companies mentioned herein or of any other person referred to in this document. Although all information has been obtained from, and relied on sources believed to be reliable, no undertaking, representation or warranty, express or implied, is made in relation to the accuracy or completeness of the information presented herein or any other written or oral communications with or information provided, or its suitability for any particular purpose.