This ITPEnergised insights series examines the techno-economics of solar PV and battery storage colocation projects in the GB market. The series is arranged with an introduction to battery storage first, then builds from this in the remainder of the series to discuss the key value drivers of additionally including solar PV with battery storage in colocation (figures are illustrative).

- Part 1 – Battery Storage and Energy Arbitrage

- Part 2 – Introducing the Techno-Economics of Solar PV and Battery Storage Colocation Projects

- Part 3 – Impact of Wholesale Price Volatility on Solar PV and Battery Colocation Techno-Economics

- Part 4 – Key Drivers of Solar PV and Battery Colocation Techno-Economics

Part 3 – Impact of Wholesale Price Volatility on Solar PV and Battery Colocation Techno-Economics

Wholesale Power Pricing volatility, maxima and minima and intra-day change has a material bearing on the techno-economics of a colocation project, driving stronger battery economics when prices are volatile or weakening battery economics of a colocation project when prices are more stable and less volatile. As intermittent renewable generation is added to the power grid, this tends to increase volatility within the energy system. This volatility then needs to be corrected in real time for energy balance, frequency, voltage, harmonics and so on which stems from a legacy grid design emanating from the 1890s George Westinghouse grid.

So, battery storage, other forms of storage, synchronous condensers, new technologies embedded within the grid and promising green hydrogen are among current solutions that help to solve the incompatibility of intermittent generation with this fragile grid; a grid that needs to function within very strict operational tolerances in real time. Even when there is energy demand and supply balance, for example, the National Grid still calls on batteries to restore power quality.

Techno-economic Framework – Case 1 Standalone Battery

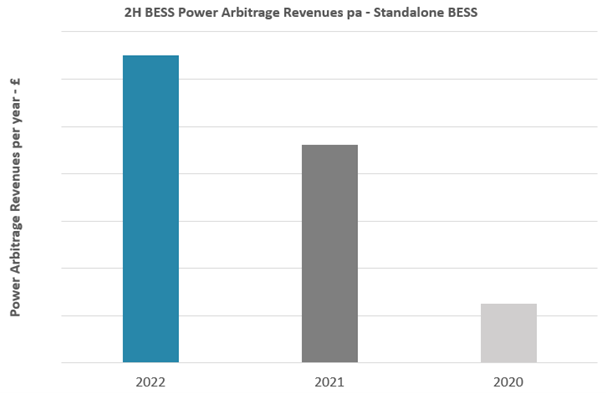

We learned in Part 1 about the increasing volatility in wholesale power pricing. If we use a 2022 wholesale power pricing year compared to 2021 and 2020 power pricing years, this shows a strong uplift in the potential of battery wholesale power arbitrage revenues per year. These are the maximum wholesale power arbitrage revenues per year; there may be times when other revenue streams are more valuable, affecting the dispatch decision, so these values may be lower. We provide an illustration of this impact in Figure 1 below.

As can be seen from the power arbitrage chart, there is a noticeable and material uplift in the battery economics and therefore the colocation economics the more wholesale power pricing volatility increases. We would expect volatility to continue to increase as we journey to Net Zero as more intermittent renewable generation is added to the power grid. Colocation projects are good in practice as they can help to provide a balancing service at the point of connection into the power grid itself.

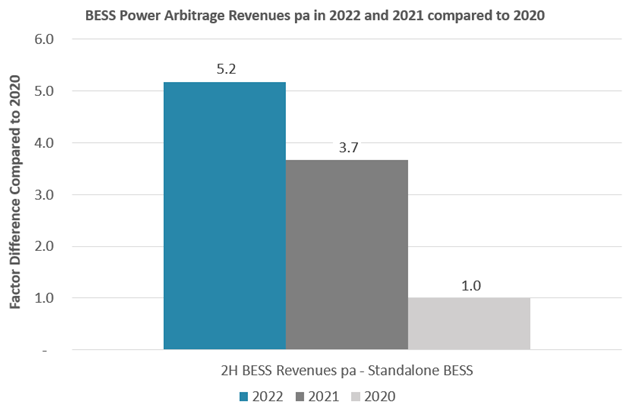

The quantum of the potential power arbitrage going from a base year of 2020 to 2022 can be additionally shown in the chart below.

Potential battery revenues from power arbitrage in 2022 has risen 5.2x and 3.7x in 2021 compared to the base year of 2020.

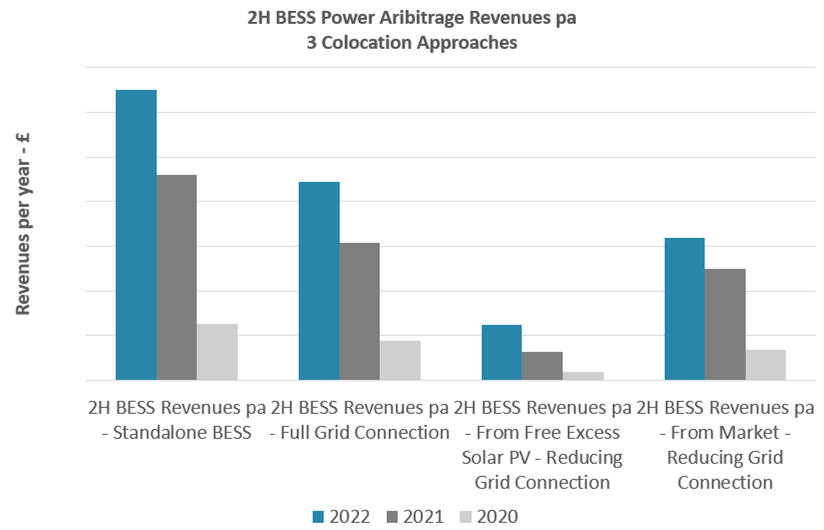

Techno-economic Framework – Case 2 Full Sized Grid Connection

This is the case where we maintain a full-sized grid connection that can export all of the solar PV capacity with a battery also sized at this level from a capacity perspective. The potential battery revenues from this case 2 is shown below in Figure 4 with the other cases.

Techno-economic Framework – Case 3 Reduced Sized Grid Connection

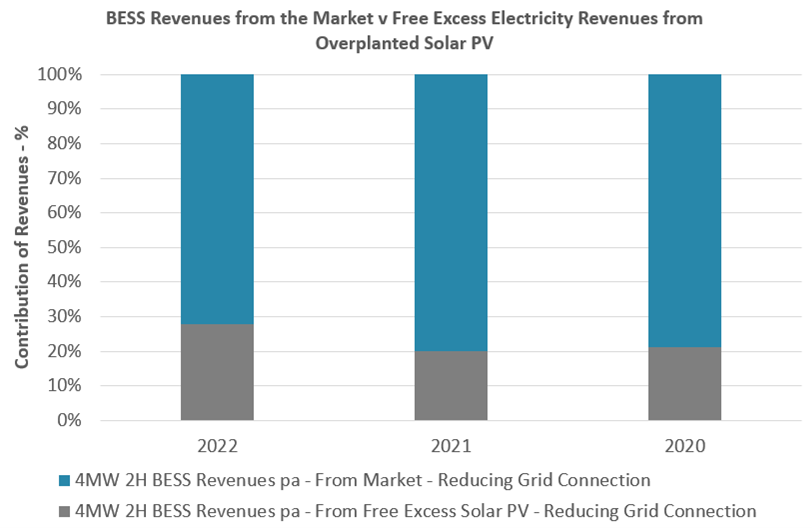

In the case where we reduce the grid connection and overplant the solar PV we force excess electricity from the solar PV to charge the battery. This still allows the battery to operate as a standalone battery when the solar PV is not generating. Across 2020-2021, around 72-80% of the total potential power arbitrage revenues comes from the times when the solar PV is not generating. This is shown in Figure 3 below.

The battery capacity is smaller than case 1 and 2 and has been prorated upwards to the same capacity to enable a more like for like comparison. The potential battery revenues from this case 3 is shown below in Figure 4 along with the other two cases.

You can view and download a PDF of this article here.

To find out how we can help you with your colocation projects and portfolios:

- Optimise the size your colocation project with corresponding techno economic KPIs;

- Support your colocation grid connection;

- Carry out solar PV energy yield assessments;

- Support environmental permitting; and

- Provide accompanying due diligence services,

please contact Peter Lo, Head of Onshore Renewables and Storage at peter.lo@itpenergised.com.

© Copyright 2023 ITPEnergised. The concepts and information contained in this document are the property of Energised Environments Limited, ITPE Ltd and Xero Energy Limited, trading as ITPEnergised. Use or copying of this document in whole or in part without the written permission of ITPEnergised companies constitutes an infringement of copyright unless otherwise expressly agreed by contract.

These materials are not intended to be and do not constitute a recommendation to any person or entity as to whether to acquire or dispose of or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient relying on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipient’s own professional advisors and such other experts as it deems relevant.

In preparing this document, ITPEnergised has relied on publicly available information and has assumed, without independent verification, the accuracy and completeness of all such information. To the extent permitted by law, ITPEnergised does not accept any liability whatsoever for any loss howsoever arising, directly or indirectly, from use of or reliance on, this document or any other written or oral communications with or information provided to the recipient in connection with its subject matter. ITPEnergised has not conducted any evaluation or appraisal of any assets or liabilities of the company or companies mentioned herein or of any other person referred to in this document. Although all information has been obtained from, and relied on sources believed to be reliable, no undertaking, representation or warranty, express or implied, is made in relation to the accuracy or completeness of the information presented herein or any other written or oral communications with or information provided, or its suitability for any particular purpose.