As we kick-off 2023, this new Thought Leadership series will take stock of recent energy sector events in what has been, and still is, an unprecedented and tumultuous period. Over the coming weeks we will look at the opportunities and challenges we foresee in the sectors we work in, how we can help you progress and be successful in your sustainability journey and shine a spotlight on some key expertise areas where our trusted advisors are leading the way. The following are some of the key issues our Sector and Service leads have flagged as key issues and observations, some of which we’ll explore in more detail in the upcoming series of articles.

Energy crisis

The conflict in Ukraine in 2022 has caused oil and gas prices to increase by pricing in uncertainty due to concerns about disruption to supply. With electricity prices linked to the gas price this has contributed to higher 2022 wholesale electricity pricing. But other factors have also contributed: Although 2022 was warmest on record for UK, businesses and households are still facing cost of living increase in part due to energy costs; cold snaps in 2020-21 have driven gas shortages across Europe; LNG demand has seen higher levels in Asia leaving less LNG shipments available for Europe; closure of Nord Stream 1 gas pipeline linking Russia to Germany; postponement of Nord Stream 2; pent up demand post Covid lockdown restrictions; lower wind resources; the increasing cost of balancing the grid; nuclear plant outages and lower gas storage reserves. Since 2021 some 28 energy suppliers have gone into administration.

Energy Price Guarantees

In response energy regulator Ofgem has announced its quarterly update to the energy price cap for the period 1 January – 31 March 2023. The price cap is set to rise to an annual level of £4,279 in January 2023, but bill-payers remain protected under the government’s Energy Price Guarantee (EPG) which caps the unit price of energy at 34.0p/kWh for electricity and 10.3p/kWh for gas.

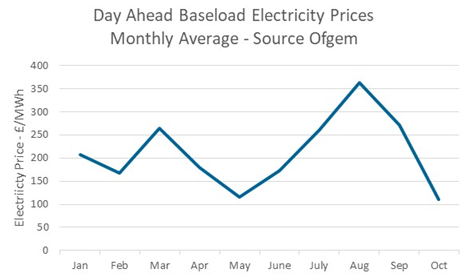

PPA pricing – double digit rise

Amid the energy crisis, European and UK PPA (as well as N America) pricing for wind and solar PV has been disrupted. UK solar PV has seen stronger quarter on quarter growth of over 50% towards the end of 2022 versus earlier in the year. UK wind has been on a more volatile journey with some quarters higher and lower than previous quarters in 2022 with a net growth of over 15% in 2022. The UK August 2022 average monthly baseload electricity price peaks at around £364/MWh (see table below). We wait for a peaceful Ukraine conflict resolution and a potential normalisation to pre conflict pricing levels.

UKETS carbon pricing

This has also risen from 2021 levels but has remained relatively flat at around £80 per tonne in 2022. Contract for Difference (CfD) has the Low Carbon Company (LCCC) overseeing around 69 CfD contracts representing around 22.66TWh of energy, which is enough to power Scotland. The LCCC expects further payments from generators throughout 2022 and into early 2023 enabling them to reduce the levy on consumer electricity bills to essentially zero (the lowest level allowed).

Traction of digital tools and innovation

This is on the rise with corporates mandating the development of digital tools and innovation as a new dedicated role within their organisations. ITPEnergised has embraced this as a founding strategic pillar of its business and has developed a powerful digital platform called the Net Zero Accelerator® that augments our traditional consulting with digital tools designed to reduce cost, time and friction by at least 50x. The tools are accelerating our client’s ability to prioritise and identify value drivers for projects and portfolios much more quickly providing a competitive edge in transaction work. We have also formed “ITPDigitised” internally to improve operational efficiency by digitising manual tasks and have identified >>1,000 working days of savings. This also creates a platform for positive employee engagement in the current squeeze on human capital.

War on talent

As identified in our thought leadership series on innovation in 2022 – that Net Zero would become a numbers game on all fronts – we predicted that a corresponding increase in human capital will be required to match the increase in Net Zero capital flowing into the sector. We have seen an increase on the pressure to attract and retain human capital and have observed that talent from other vertical markets is moving into clean energy, both into conventional renewables technologies, and on the more disruptive innovation that seeks to get a foothold in well-established global business models that are worth £ trillions per year. The good thing is that Net Zero provides tremendous life purpose appealing to Gen Z and therefore our next generation of clean energy pioneers.

Offshore Wind

Earlier in 2022, Crown Estate Scotland awarded nearly 25GW in its ScotWind offshore wind lease auction at strike prices making many of these projects viable. Key winners include Scottish Power Renewables, Shell, BP and SSE but with many more companies benefitting including investment in the supply chain in Scotland.

The Crown Estate’s leasing process for floating wind in the Celtic Sea is expected to launch mid-2023 and is anticipated to deliver 4GW of floating wind farms by 2035. The c 4.5GW Innovation and Targeted Oil & Gas (INTOG) leasing round is expected in April 2023, focusing on offshore wind projects that will directly reduce emissions from oil & gas production and boost further innovation.

Contracts for Difference (CfD) Allocation Round 4 (AR4)

In July of 2022 the AR4 results were announced with the potential to deliver nearly 11GW of new clean energy by 2029 – enough to power around 12million homes. Onshore wind secured almost 0.9GW of new capacity, with solar securing more than 2.2GW. We welcome the return of onshore renewables to this scheme for the first time since round 1.

Contracts for Difference (CfD) Allocation Round 5 (AR5)

AR5 will start in March 2023 and represents the move from biennial to annual auctions for the first time.

The UK development pipeline

Development is booming across all clean technologies and energy storage with material acceleration seen in the past 12 months as capital flows in to support our national net zero ambitions. Battery storage schemes are really coming into their own as a potential proportion of installed UK capacity, with both standalone and co-located plays, beside both renewables and fossil fuel generation. Larger projects are being developed to address the future intermittency of Scotwind and to enable the replanting of incumbent CCGT sites. Grid connection continues to be a challenge both in terms of timing and the firmness of connection.

Rising deployment of hybrid renewables

As predicted by ITPEnergised in its thought leadership series in 2021 hybrid renewables development is on the rise. This can be at either planning stages or for existing assets. According to The Government’s Department for Business, Energy and Industrial Strategy (BEIS) Renewable Energy Planning Database (October 2022) over a third, or 321 out of 911 battery projects with planning applications submitted or awaiting construction are now co-located with a renewables generator. Increasing the load factor of an existing or future grid connection has the potential to powerfully unlock economic and environmental value.

Green hydrogen

Green hydrogen momentum is growing as it has the multiple ability to not only help decarbonise the electricity sector but also transport and heating sectors too. BEIS has become more specific in 2022 particularly around both The Hydrogen Investment Package and Net Zero Hydrogen Fund but has more work to go. We await with interest in 2023 the first subsidy awards for up to 1GW for ‘electrolytic projects’ under the UK Governments Hydrogen Business Model (HBM).

ESG as board level agenda

As usual for the UK market and globally as financial institutions increase requirements for reporting and disclosure of material aspects. COP26 shone a spotlight on the increasing risks from Climate Change and society’s frustration with progress to date. ESG is firmly on Board-level agendas and is key to building long term value creation and resilience. ESG disclosures and commitments go hand in hand with responsible investment, with a growing pool of finance specifically focused on supporting net zero. The financial community plays a vital role to help mobilise capital to decarbonise the economy and build a resilient and sustainable future and our ESG Transparency : A Private Equity & Venture Capital Index offered a fresh, independent perspective on the importance of ESG transparency and provided an important snapshot into what is currently considered best practice in the sector. ITPEnergised continues to grow our ESG team and has recently launched our new Carbon Services which will work with clients to future-proof businesses both economically and environmentally.

M&A activities

These continue unabated with players going further upstream in the asset/ portfolio life cycle including earlier than ready-to-build stage to capture these opportunities and pay lower premiums. Competition continues to be strong, there appears to still be more capital than projects in the UK market.

New entrants

Positioning for investment in the clean energy space e.g., oil and gas with increasing ESG pressure.

Levels of sophistication in the renewables space

This has room to grow, particularly with respect to new digital ways of working which clash with legacy style investment committees and “ownership” of traditional modelling tools and approaches.

Consultations and regulatory change

The Review of Electricity Market Arrangements (REMA) is driven by the UK commitment to better enable the full decarbonisation of the electricity sector by 2035 to support Net Zero by at least 2050. There are some material proposals that have been consulted on including a move to Locational Marginal Pricing, the de-pegging of electricity price from gas, and a two-part market for intermittent and firm power. The potential impact of these proposals will create clear winners and losers, impacting legacy projects, and influencing the investment and growth strategy for incumbents and new entrants alike. We see REMA as one of the largest ever market arrangement changes on the horizon and continue to watch this space for developments.

On other regulatory impacts, we continue our TNUoS charges prediction service which has been going for several years based on our one-of-a-kind GB Network Digital Twin. It has since been recently updated with the latest 2022 data provided by National Grid Future Energy Scenarios (FES) and the Network Options Assessment (NOA). BSUoS payments are proposed to be removed from generators from 2023.

Success in 2023

Our overarching view of how to be successful in 2023 is enabled through:

- The ability to tap into an extensive network to feed the development and acquisition pipeline.

- ITPEnergised is uniquely positioned in the wider market as a Trusted Advisor to help you make these “ready to build” project and portfolio connections and feed your growth funnel.

- The ability to tap into powerful digital models to accelerate progress and insights that drive shareholder value.

- ITPEnergised has a unique advantage through our digital platform, the Net Zero Accelerator®, where we have seen first-hand the tangible benefits clients have enjoyed in screening projects and portfolios. Our digital tools promote rapid feasibility stage techno-economic assessments to be carried out, providing superior team focus during live transaction work and a structured ability to prioritise greenfield development opportunities to identify and then double down on rising stars.

- The ability to navigate an increasingly constrained GB grid at transmission and distribution level.

- ITPEnergised has developed several tools over the past several years that enable our clients to become more accurately informed of when and where grid capacity is likely to be available, to successfully develop new projects. This includes feasibility studies, wide area network (WAN) searches and power system studies. On the commercial side we also have a digital twin of the GB network which we use in many ways, one of which being to predict transmission network use of system (TNUoS) charges. We also keep abreast of the key regulatory changes that impact grid and have strong relationships with National Grid and the DNOs.

You can download a PDF of this article here.

For more information or a chat about any of the above, please reach out to Jonny Clark, Managing Director at jonny.clark@itpenergised.com or Peter Lo, Director of Digital Innovation at peter.lo@itpenergised.com.